Is Homeownership a Sound Investment?

Homeownership is considered an integral part of the American Dream, with it comes the right of property ownership which is distinctly titled in that person(s) name, and the right to possess and protect that property from state or civilian intrusion. The 5th Amendment provided in the US Constitution separates the US from many other countries, whose personal property rights are at the mercy of their governing nation. Strong property rights have long been known to be a crucial requirement behind any developed economy, and should be continually encouraged. That being said, many homeowners believe their property to be undeniably solid investments, but is this necessarily the truth?

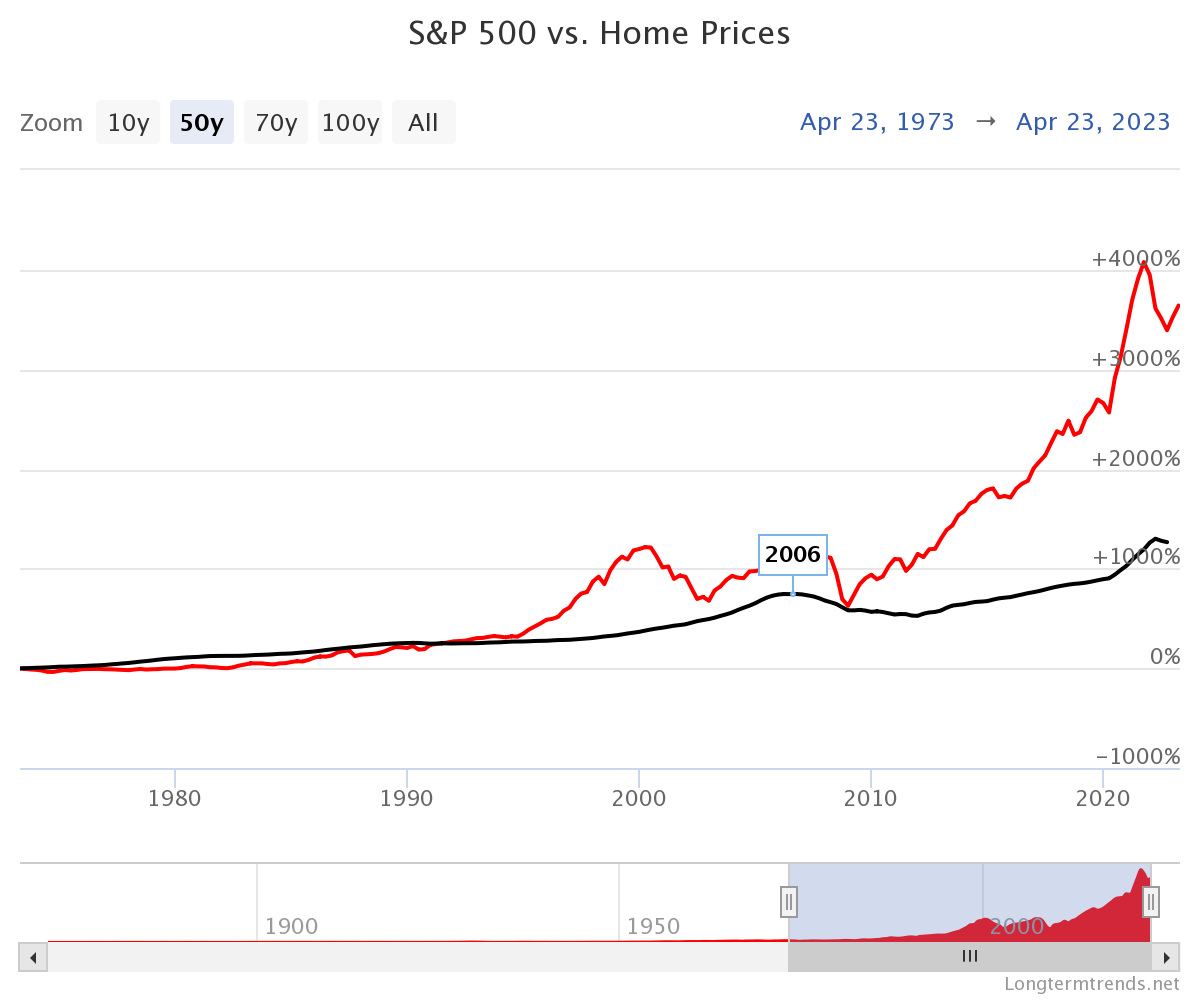

Like most things in finance, it depends. In general, owning a US stock index (i.e. S&P 500) would have been much more profitable than owning a home.

The outperformance of the S&P 500 over US home prices is easily evident from this graph. The data on this topic is rather counter-cultural to what most Americans think, likely because real estate is a physical asset that can be seen in plain view and is an easier investment concept to grasp than owning stocks. That being said, real estate has historically been less volatile when compared to stock ownership and can provide diversification benefits which in turn lowers an individual's overall risk.

The problem with viewing a principal residence as an "Investment":

- Profits may not be what they seem: While recent years have earned homeowners record profits (if they sold their home), historically speaking, significantly fewer profits are typically realized from selling a principal residence when compared to the post-pandemic housing market.

- Costs tend to be ignored: To truly determine the "gain" that an investment has provided, all implicit costs should be accounted for, such as mortgage interest, maintenance, property taxes (and capital gains taxes if a property is sold for a profit), insurance and transactional costs, etc. All of these expenses can significantly eat away at an investment's net return and impact profits negatively.

- Everybody has to live somewhere: Even if an owner has sold their home for a profit, the proceeds from the sale will likely be reinvested in another residence. If an owner sold their property for a sizeable profit in the post-covid housing market, they will likely still need to reinvest at least a portion of the proceeds into a new home. Chances are, the new residence will have appreciated to some extent as well, further depreciating the return on investment.

- The only potential return is through value appreciation: Simply put, a principal residence is likely not generating any income, so the only way to earn a profit is through increases in the home's value itself. Meanwhile, stocks can increase their expected total return through price appreciation and dividend payments returned to shareholders, similar to how a rental property produces rent payments from tenants and stands to benefit from value appreciation as well.

An Asset or a Liability:

- The average American has nearly 70% of their total net worth tied up in the current value of their home.

As a result, the 2008 Global Financial Crisis wreaked havoc on many families across the nation, especially those with high levels of debt owed on their homes. Because so many banks required a minimal or zero initial down payment for home financing and ignored poor credit histories, many people interested in being homeowners sought to take advantage of the opportunity.

This risk can be mitigated by maintaining a healthy loan-to-value ratio (80% is a commonly recommended LTV ratio). This is highly advisable to prevent foreclosure in case of unexpected misfortunes, such as job loss, expensive medical bills, etc. An adequately funded emergency fund (3-6 months of liquid savings) is also a necessary option that can help safeguard against delinquency.

Homeownership is great, but banking on it to be an outstanding investment is likely a mistake.

Betting on your home to provide for future financial needs/goals is risky, and may be costing you more in the form of missed opportunities than just simply monetary costs. Consider gaining exposure to a variety of asset classes, and adjust your exposure to each respective investment as your needs and wants change in life.