The Easiest Way to Invest in Real Estate

Before 1960, investing in real estate was primarily reserved for the wealthy. Sure, many of those in the middle and lower classes may have been able to purchase a home or similar type of property to be used as a principal residence, but investing in large-scale commercial real estate was basically out of reach for most Americans. This changed when President Eisenhower signed into law the ability for investors to buy and sell relatively liquid (easily tradeable investments) positions in real estate in the same way that stocks and bonds are traded on the open market. This led to the creation of many US-based Real Estate Investment Trusts (with international firms following close behind), also known as REITs (pronounced "Reets"), and has ultimately culminated in US REITs owning roughly $4.5 trillion of real estate across the nation.

REITs are investment companies that buy/sell, develop, operate, and or finance income-producing real estate. To maintain certain tax advantages available to REITs, there are requirements in place that they must adhere to:

- Distribute 90% of taxable income

- A maximum of 50% of its shares may be held by five or less investors

- A minimum of 75% of total REIT assets must be invested in real estate, cash, or Treasury securities

- A minimum of 75% of total REIT income must be from real estate-related interests

- View the full list of REIT requirements here

By meeting these requirements, REITs are able to avoid paying corporate taxes and defer capital distributions, among other benefits.

Types of REITs

- Equity: These REITs make up the majority of the REIT market, and own income-producing real estate across a variety of sectors

- Mortgage (mREITs): Income is generated by providing financing for real estate operations, generally in the form of Mortgage Backed Securities (MBSs) which earn interest on loans provided to property owners.

- Hybrid: A cross between the two, easy enough.

REIT Sectors

Just as stocks can have varying degrees of risk depending on the industry in which they operate (among many other factors), so do REITs. For example, hotel REITs are likely more volatile than healthcare REITs, this is relatively simple to understand as the hotel industry is subject to the rise and fall of consumer demand during periods of economic expansion and recession. Other notable REIT sectors include data center, office space, residential, timber, etc.

Another factor to consider is the type of leases that REITs provide to tenants.

- Net Lease: The most "basic" form of a lease, in which the tenant is typically only required to pay rent and handle basic building maintenance.

- Double Net Lease (NN): The tenant is responsible for interior building maintenance, in addition to property and insurance costs. The REIT is expected to provide basic building structure maintenance.

- Triple Net Lease (NNN): The tenant is essentially expected to handle all maintenance, insurance costs, and tax expenses. These leases are oftentimes agreed with tenants who earn consistent cash flows and can lock into a long-term lease without much concern for market conditions.

REIT Metrics

Being that REITs are separate entities when compared to stocks, their performance and or financial well-being should be measured in a different fashion than typical companies bought and sold on the stock market.

- Adjusted Funds From Operations (AFFO): AFFO provides investors with an estimate of the cash flows required for the REIT to maintain the existing property. This information is typically found on REITs financial statements and is preferred by most REIT experts over Funds From Operations (FFO) as it is more accurate. Consistent and stable growth in AFFO is a good sign that a REIT growing steadily and that increased cash flows (and dividend payments to investors) may be on the horizon.

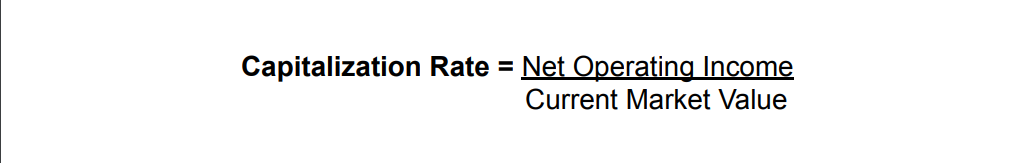

- Capitalization Rate: The "Cap" rate provides investors with an expected return on investment. Cap rates provide investors with an estimate of when they can expect to recoup their principal investment in full, so a 10% cap rate coincides with the expectation that the investor will need to wait 10 years before earning back their original investment. It is plain to see that a higher cap rate equates to a higher risk being taken on, but a potentially higher return as well.

Are REITs Worth the Investment?

In short, yes. High-quality REITs are worthy of inclusion in most all investment portfolios, and for good reason. Outpacing inflation, consistent total returns (price appreciation & dividends), and outperformance of other asset classes are a few reasons why REITs warrant an investment.

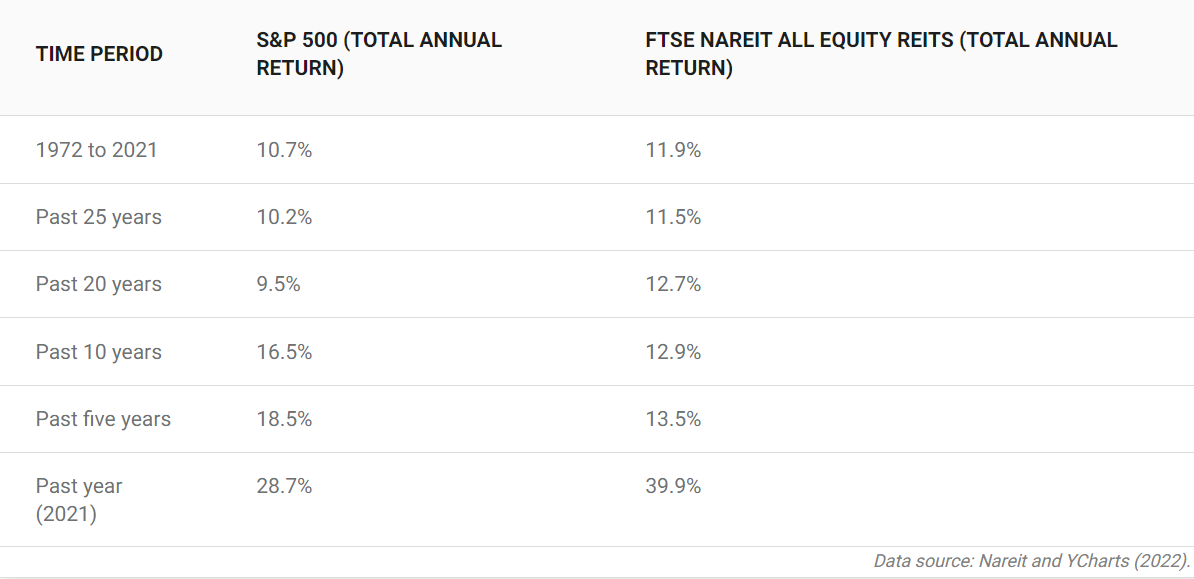

The S&P 500 has gotten the better of REITs over recent time periods, though it should be noted that stocks inherently possess more risk than most equity REITs.

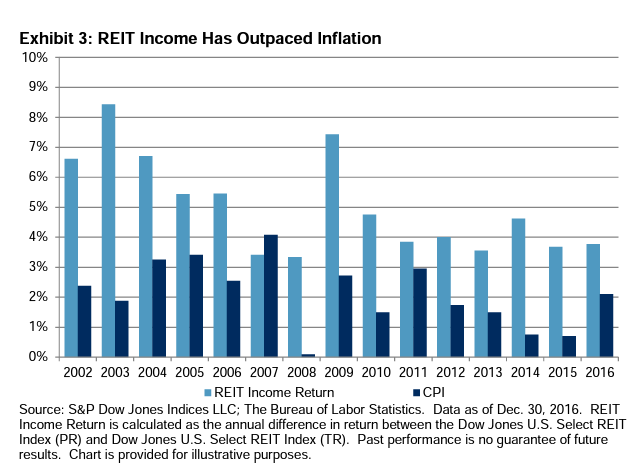

Inflation is and should be of concern for investors, this risk can be mitigated thanks to income-producing REITs. Only in 2008, when the real estate industry suffered greatly from misrepresented Mortgage Backed Securities sold to investors, did REITs lose out to CPI in this time period.

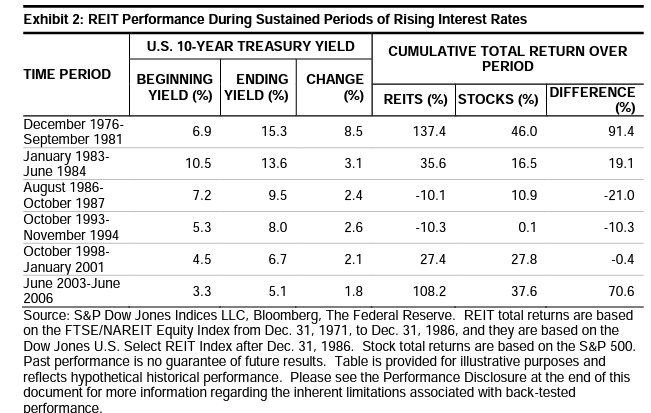

A common criticism of REITs, and real estate in general, is that their performance suffers considerably in periods of rising interest rates. While it is evident that asset values of real estate tend to decline during these periods, cash flow still remains king and provides stability as shown above. The time periods above (starting with 1976) were during times of economic uncertainty and rising inflation. The Federal Reserve attempts to utilize interest rates strategically to combat inflation by slowing financing activities, consumer expenditure, and job growth nationwide. All these factors tend to weigh on almost all investments, though it does not necessarily have to be as devastating as with the 2008 recession, or the great depression. Despite rising interest rates, REITs outperformed the stock market 4 out of 6 times stretching back to 1976.

REITs to Invest in

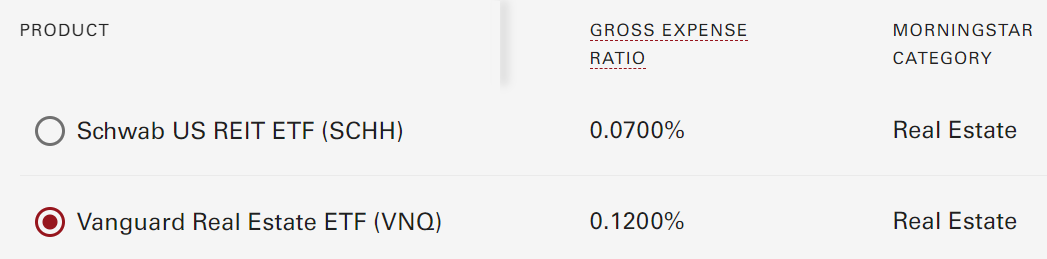

Rather than having to research individual REITs to include in your portfolio, consider buying a low-cost, broad-based index that contains more than 100 individual REITs across a multitude of industry sectors.

As discussed previously, no asset class should be viewed as the end-all-be-all of investments. REITs may have outperformed stocks on many occasions, but having a heavy concentration in the former would have provided sub-par investment returns over the last decade. The optimal choice would be to include a healthy dose of REITs in an investor's total portfolio, to maximize investment diversification (5%-20% of an investor's total portfolio invested in REITs may be an appropriate amount to consider, depending on the investor's situation).

This website is a general communication being provided for informational purposes only. It is educational in nature and not designed to be a recommendation for any specific investment product, strategy, plan feature or other purposes.